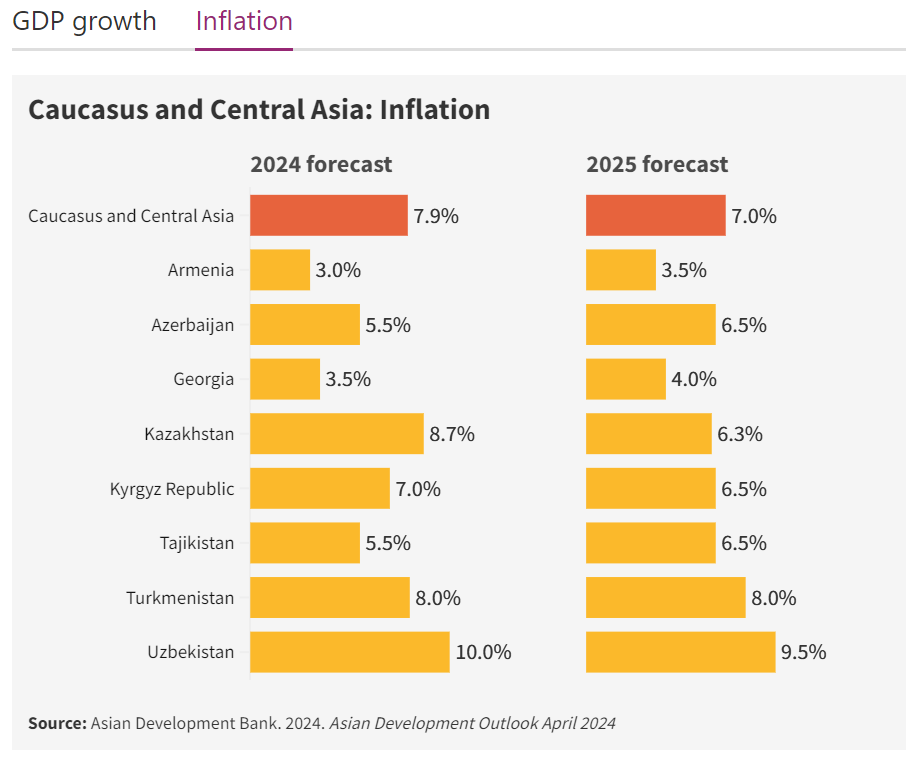

Growth edged up in 2023 on faster expansion in industry and agriculture. Inflation decelerated with tight monetary policy and continued tax exemption for essential foods. Growth is forecast to slow in 2024 and rise slightly in 2025 as increases in administered prices limit the rise in real disposable household income, cooling demand. Inflation will remain high as structural reforms in energy lead to higher administered prices, despite continued monetary tightening. Green development policy is critical for accelerating the transition to a green economy.

Economic Performance.

Faster expansion in industry and agriculture helped accelerate economic growth.

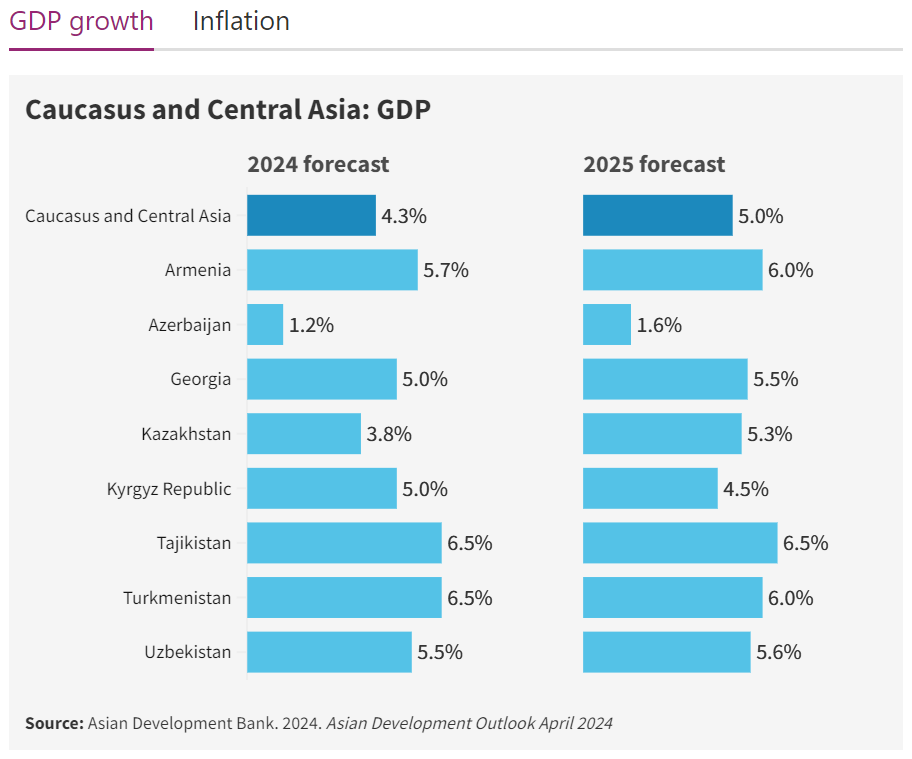

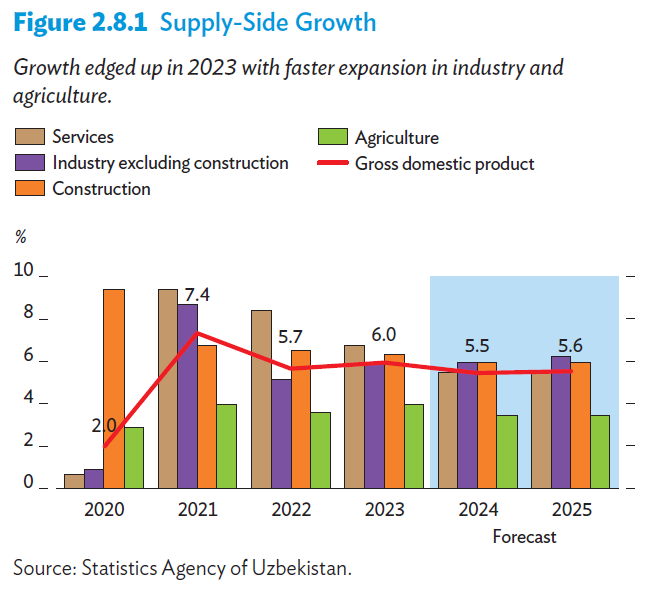

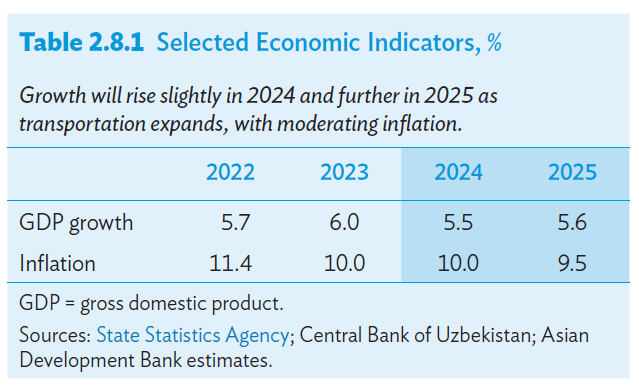

The State Statistics Agency reported growth rising from 5.7% in 2022 to 6.0% in 2023 (Figure 2.8.1.). On the supply side expansion in industry increased from 5.3% in 2022 to 6.0% as healthy external and domestic demand led to gains in metal and food processing and textile manufacturing. Mining and quarrying grew by a modest 1.0% as reserve depletion caused the extraction of oil and gas to plummet. Coal output in contrast expanded with increased demand for household heating during the cold season. Growth in agriculture accelerated from 3.6% in 2022 to 4.0% with healthy demand for cotton from textile-exporting enterprises, gains in wheat and livestock production for domestic consumption, and increased horticulture output from greater crop diversification. Expansion in construction slowed marginally, from 6.6% in 2022 to 6.4% with similar growth in new buildings and structures. Growth in services slowed from 8.5% in 2022 to 6.8% as expansion in accommodation and food services, transportation, and storage declined with slower expansion in private consumption and cooling business activities, despite a 27% rise in tourist arrivals.

Higher investment boosted growth on the demand side.

Growth in private consumption fell from 11.0% in 2022 to an estimated 6.3% in 2023 as high inflation and a 32.9% drop in cross-border transfers trimmed real household income growth despite increases in nominal public wages pensions and social assistance. Public consumption growth slowed from 3.5% in 2022 to an estimated 2.9% reflecting a cut in public spending in the second half of 2023. Expansion in investment surged from 3.1% to 22.1%. This reflected greater private investment including a jump in foreign direct investment to upgrade manufacturing as well as heavy public investment in electricity and natural gas supply networks and urban infrastructure. The deficit in net exports of goods and services widened by 24.3% as growth in imports of petrochemicals machinery and equipment mainly for industry outpaced growth in exports notably services and gold.

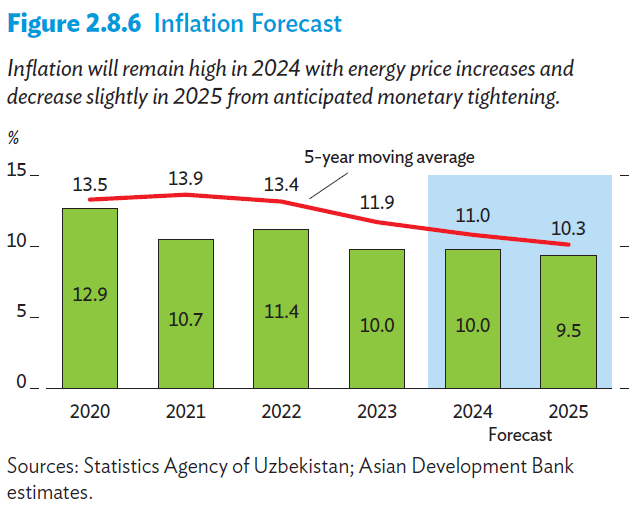

Inflation slowed in 2023 as monetary policy remained tight and the government retained a tax exemption for essential foods.

Inflation decreased from 11.4% in 2022 to 10.0% in 2023 as the Central Bank of Uzbekistan kept monetary policy tight lowering its policy rate by only 100 basis points, from 15% to 14%, in March 2023. In addition, the government extended the exemption of essential food products from value-added tax and custom duties Inflation declined from 15.3% in 2022 to 12.1% for food and from 10.0% to 8.5% for other goods. However, inflation in services surged from 7.0% to 8.2% because of demand-side pressures including an October rise in administered energy prices. In December 2023 year-on-year inflation decreased to 8.4% close to the central bank target though a rise in energy prices may make the slowdown temporary.

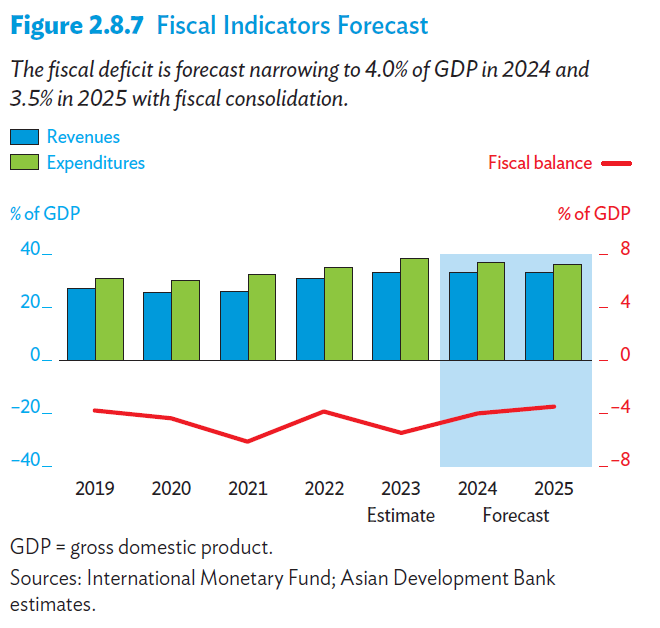

The fiscal deficit expanded from 3.9% of GDP in 2022 to an estimated 5.5% as spending outgrew revenue.

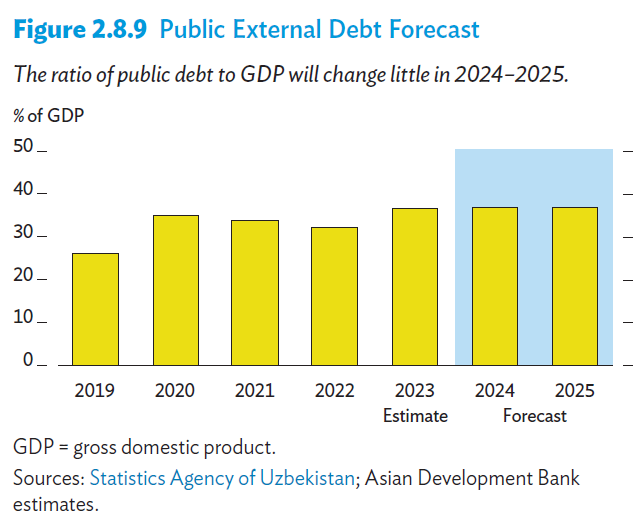

With improved tax collection and a broadening of the tax base, revenue rose from 29.7% of GDP to an estimated 33.0% in 2023. Stable prices for gold, copper, petrochemicals, and other key commodities produced by state enterprises, the largest taxpayers, sustained a steady revenue stream to the budget. Outlays rose from 33.9% of GDP to an estimated 38.5%, reflecting increased social spending, higher subsidies for state-owned enterprises, and increased public wages and pensions. Most of the fiscal deficit was financed by external borrowing, raising public debt from 36.4% of GDP to 37.7%. In October 2023, Uzbekistan issued $349.1 million in green sovereign international bonds denominated in Uzbek sum on the London Stock Exchange, along with conventional international bonds valued at $660 million.

Bank lending to the economy expanded further in 2023.

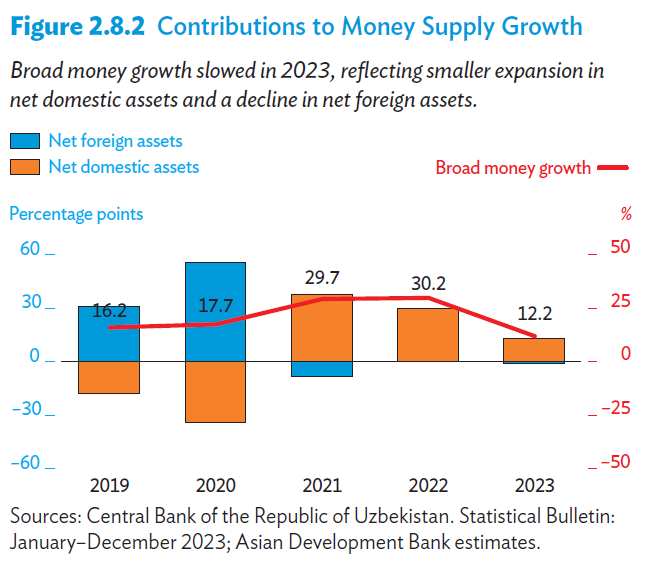

Credit to the economy rose by 23.3%, up from 21.4% a year earlier, on rising demand from industry, services, and higher mortgage lending. The share of nonperforming loans moderated from 3.6% of all loans in 2022 to 3.5% in 2023. Growth in broad money plunged from 30.2% in 2022 to 12.2% as expansion of the local currency money supply slowed by more than half from 39.0% in 2022 to 18.4% and growth in foreign currency deposits slowed equally steeply from 10.8% to 5.1% (Figure 2.8.2).

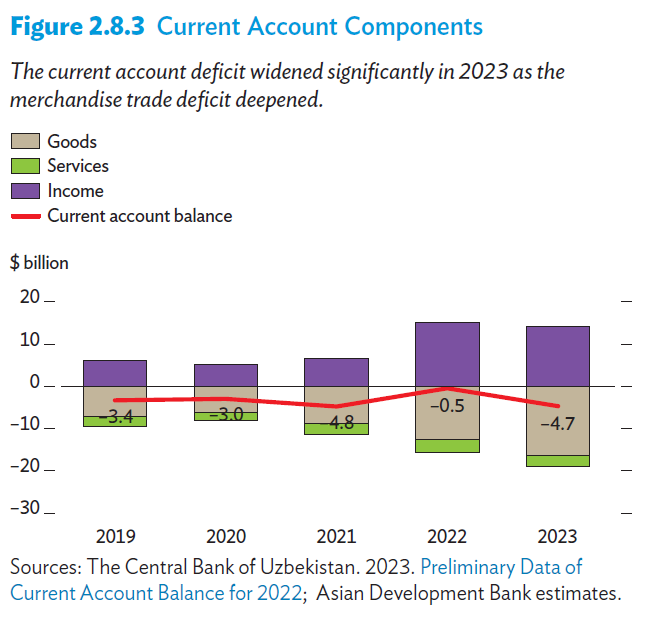

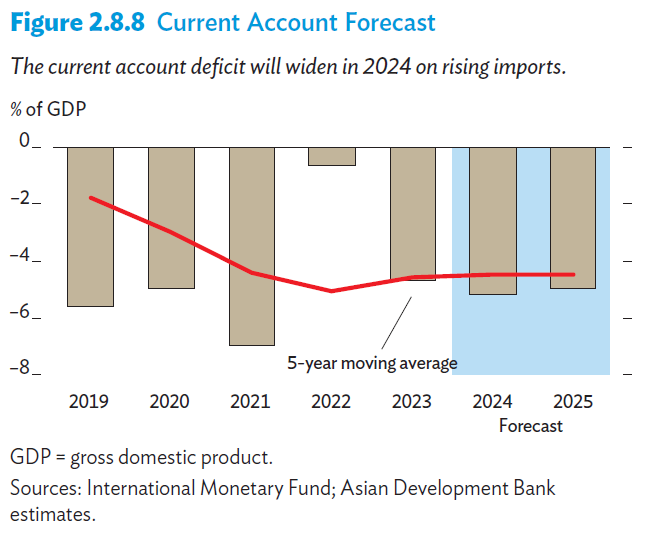

Despite a surge in gold exports, the current account deficit widened as imports rose faster than exports (Figure 2.8.3).

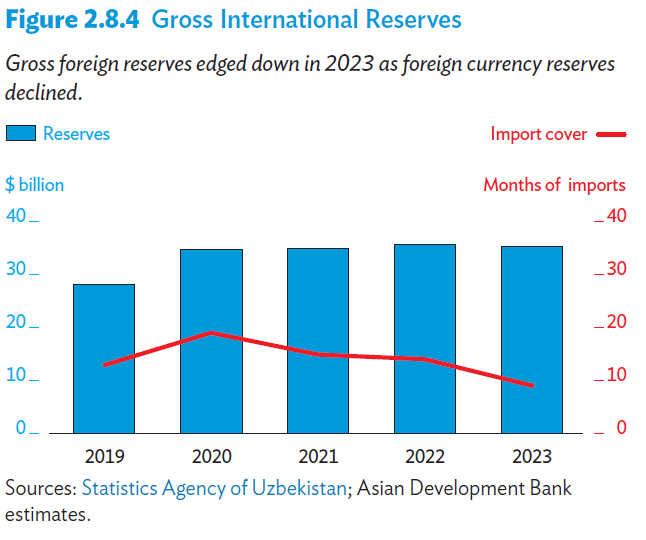

High gold prices helped total exports rise by 23.8%, up from 15.9% in 2022, as non-gold exports increased by 4.2%. With robust domestic demand, import growth accelerated to 24.0% from 20.6% in 2022, driven by imports of cars, equipment, and petroleum products, alongside 9.8% depreciation of the currency against the US dollar. Growth in remittances returned to its medium-term trend, dropping to 12.6% of GDP after 19.2% growth in 2022, as the number of migrant workers decreased and the Russian ruble depreciated. Gross foreign reserves edged down from $35.8 billion at the end of 2022 to $35.6 billion a year later, providing cover for 9 months of imports, with a 6.8% rise in gold reserves largely offsetting a 19.5% decline in foreign currency reserves (Figure 2.8.4).

Economic Prospects

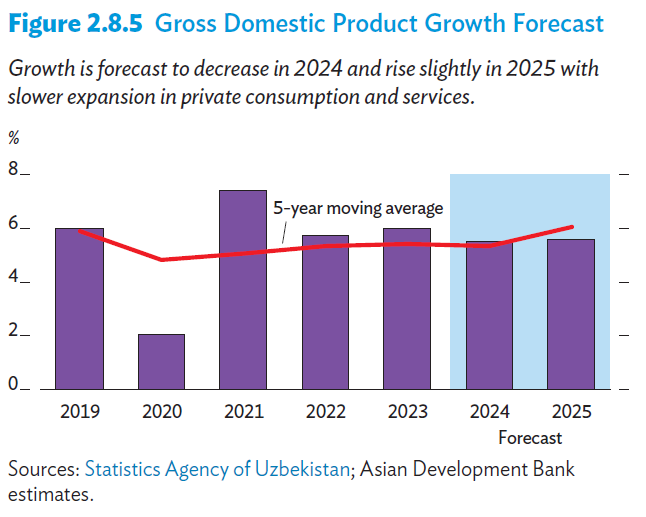

Growth is forecast to weaken, especially in services and agriculture, as administered price increases limit a rise in real domestic demand. It will slow to 5.5% in 2024 before rising slightly to 5.6% in 2025 from a pickup in industry (Figure 2.8.5).

On the supply side, growth in services is anticipated to decelerate to 5.5% in both years with cooling demand for food and accommodation, storage, and transportation services. Expansion in agriculture is projected slowing to 3.5% in both years because of expected shortages of water for irrigating cotton and wheat. Growth in construction is forecast to decelerate to 6.0% in both years, reflecting slower expansion in housing, local infrastructure, and upgrades to manufacturing plants. Rising external demand for food and textiles and domestic demand for mining and quarrying are projected to sustain industry growth at 6.0% in 2024 and raise it to 6.3% in 2025.

On the demand side, private consumption and investment growth will slow.

Ongoing structural reforms involving domestic price increases for energy in 2024 and 2025 are forecast to trim real disposable household income growth. This will cool demand and moderate growth in private consumption to 5.0% in 2024 and 5.3% in 2025 despite planned periodic adjustments of public wages and pensions to keep pace with inflation. In addition, commercial banks are expected to limit consumer lending and mortgages to slow rapid growth in credit to the economy. Public consumption is forecast to grow by a modest 1.0% yearly on slightly higher spending to operate and maintain social sector institutions amid anticipated fiscal consolidation during 2024–2025. With planned higher public and private investment in health care, education, urban infrastructure, and industrial facility expansion, investment is projected to grow by 8.0% in both years, down slightly from 2023. Higher imports of capital and intermediate goods for industry and transport services are expected to widen the deficit in net exports, offsetting gains in exports of textiles, food, and tourism services.

Inflation is projected little changed, despite continuing tight monetary policy, as structural reforms in energy raise administered prices.

Year- on-year inflation slowed to 9.1% in January 2024 from 12.1% a year earlier as the central bank maintained its policy rate at 14.0%. However, inflation is anticipated to remain at 10.0% in 2024 and moderate only to 9.5% in 2025, reflecting the lagged impact of energy price hikes in October 2023 and expected further domestic energy price increases in 2024 and 2025 (Figure 2.8.6). To curb inflationary pressure by slowing credit growth, commercial banks are expected to continue limiting microcredit and consumer lending, including auto loans. Moreover, the government is expected to reduce energy subsidies and policy lending, and improve the targeting of social protection payments, to narrow the fiscal deficit to 4.0% of GDP in both years.

Structural reforms and expanding social spending will limit fiscal consolidation and deficit reduction. The fiscal deficit is projected at 4.0% of GDP in 2024, narrowing to 3.5% in 2025 (Figure 2.8.7).

Revenue is expected to remain at 33.0% of GDP in 2024 and 2025 with steady tax revenue from state-owned enterprises in mining and quarrying that benefit from high prices for gold, copper, and petrochemicals. The government aims to maintain high spending for capital projects, education, health care, and social protection, while strengthening fiscal discipline by curbing outlays for unanticipated public activities and subsidies to state-owned enterprises. Expenditure is forecast as moderating to the equivalent of 37.0% of GDP in 2024 and 36.5% in 2025.

Cooling income inflows and increasing imports will expand the current account deficit.

The current account deficit is forecast to widen to around 5.0% of GDP in 2024 and 2025 on rising imports and declining remittance inflows from the Russian Federation (Figure 2.8.8). Higher demand for imported consumer products, capital and intermediate goods, and transport services is anticipated to keep import growth higher than the expansion of exports of goods and services.

Rising gold reserves are expected to raise gross foreign reserves to $36 billion in 2024 and 2025.

These reserves will provide cover for 11 months of imports in 2024 and 10 months in 2025. The authorities set a $5 billion ceiling on external borrowing in 2024 to keep total public debt below 60.0% of GDP in 2024 and 2025. External public debt is currently below 38.0% of GDP and is expected to stay at about 37.0% in 2024 and 2025 (Figure 2.8.9). With capital investment in petrochemicals, mining, and quarrying, foreign direct investment is projected to grow by 10.0% each year.

Risks to growth stem primarily from possible slowdown in Uzbekistan’s major trading partner.

Slowing growth in the Russian Federation, the main destination of migrant workers and exports of food and textiles, would weaken external demand for Uzbekistan’s processed food and garments and its migrant workers.

The drop in remittance inflow would trim households’ income, slowing private consumption growth. Tightened external financial conditions would further raise the cost of external borrowing for capital investment projects and business activities. Growing contingent liabilities from state-owned enterprises, expanding public–private partnerships, and climate change would also pose risks to growth and fiscal sustainability.

Policy Challenge—Green Development Policy

A green development policy is critical for accelerating a transition to a green economy.

In its nationally determined contributions to 2030, Uzbekistan aims to generate at least 30.0% of its electricity from renewable sources and cut greenhouse gas emissions by 35.0% per unit of GDP from 2010 levels. According to Our World in Data, as of 2020, Uzbekistan’s total emissions were 184.15 million tons of carbon dioxide equivalent, or 0.39% of global emissions, ranking the country 42nd out of 198 countries. Emissions per million dollars of GDP were 3,074 million tons, 23rd highest of 198 countries.

The government has adopted a Strategic Framework for Transitioning to a Green Economy.

The framework reflects its national commitments to the Paris Agreement and its national development strategy 2030. The government has set up the Ministry of Ecology, Environmental Protection, and Climate Change to govern climate issues. Green transitioning and fulfilling national climate commitments warrant a consolidated green development policy with cross-sectoral coordination and public participation. Uzbekistan is progressing toward diversifying its electricity generation with renewable sources and greening its public finance management.

Green development policy is fragmented among various ministries and agencies, risking inefficiency in pursuing a green economy.

The Ministry of Energy and the Ministry of Investment, Industry, and Trade both lead policy on expanding electricity generation with renewable sources, for example, while the Ministry of Economy and Finance sets strategic directions for transitioning to a green economy and oversees the adoption of green practices in public finance management. Green development policy, however, requires an institution with a mandate to coordinate and monitor the work of different ministries.

Institutionalizing a climate policy council could provide a solution.

Ideally, the Cabinet of Ministers or a similarly high-ranking government institution should lead such a council, with representatives from line ministries, the private sector, civil society organizations, and think tanks. The council’s coordinating activities could include the following: (i) adapting the service sector to climate change, (ii) training specialists with green skills to ensure labor productivity and competitiveness in a future green economy, (iii) revising and harmonizing technical regulations and standards for industrial goods with international and regional green standards and practices, (iv) adapting public transport infrastructure to electric- powered mobility and other decarbonized modes of logistics, (vi) providing transboundary management of regional public goods such as water resources due to climate change, and (vii) adapting the healthcare system to increasingly frequent heatwaves.

The detailed report can be found at the following link:

Economic Forecasts: Asian Development Outlook April 2024 | Asian Development Bank