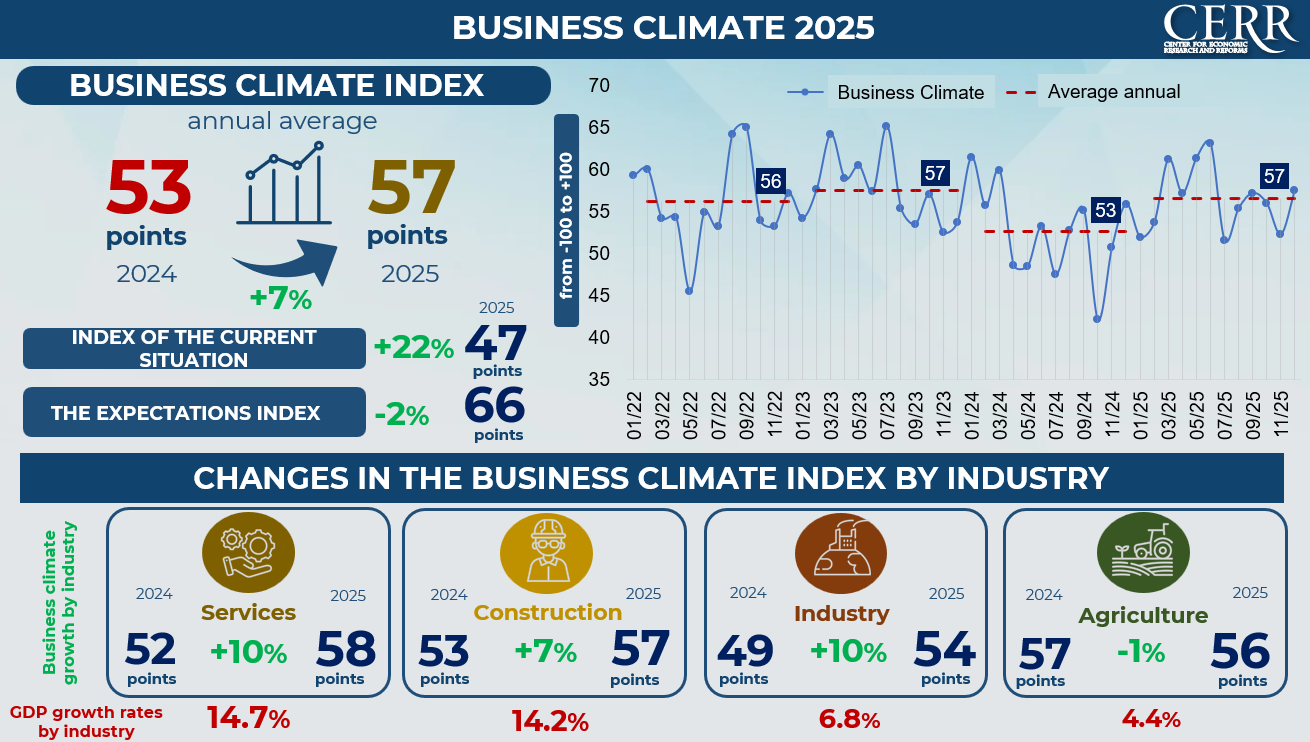

Throughout the year, the business climate remained in positive territory, with an annual average of 57 points, indicating an overall favorable business environment in Uzbekistan.

The Center for Economic Research and Reforms (CERR) presented the results of its 2025 business climate analysis, based on monthly nationwide surveys of entrepreneurs. Using the collected data, a composite Business Climate Indicator was constructed, reflecting assessments of current business conditions as well as expectations for the next three months.

Dynamics of the Composite Business Climate in Uzbekistan

According to the results of 2025, the annual average value of the Composite Business Climate Index in Uzbekistan amounted to 57 points on a scale from −100 to +100, which is 7% higher than in 2024. The growth was primarily driven by improved assessments of current conditions. The annual average value of the Current Business Conditions Index increased by 22% and reached 47 points.

At the same time, the Expectations Index declined slightly from 68 to 66 points, while remaining at a relatively high level. This reflects a certain degree of caution among enterprises regarding future prospects amid an overall improvement in perceptions of current conditions.

Over the year, the dynamics of the Composite Business Climate Index were uneven. The highest value was recorded in June at 63 points, while the lowest level was observed in January at 52 points. Fluctuations during the year reflected both seasonal factors and businesses’ adaptation to rapidly changing economic conditions.

By the end of the year, a high level of optimism among enterprises persisted. In December, the Business Climate Index stood at 58 points, increasing by 2 points compared to the end of 2024.

Sectoral and Regional Dynamics of the Business Climate Index

From a sectoral perspective, improvements in the business climate were recorded across most sectors of the economy in 2025. In the services sector, the index reached 58 points, representing an increase of 14.7%. In construction, the index stood at 57 points, up by 14.2%, while in industry it reached 54 points, increasing by 6.8%.

In agriculture, the index remained virtually unchanged at 56 points, indicating the persistence of previously established assessments of business conditions in this sector.

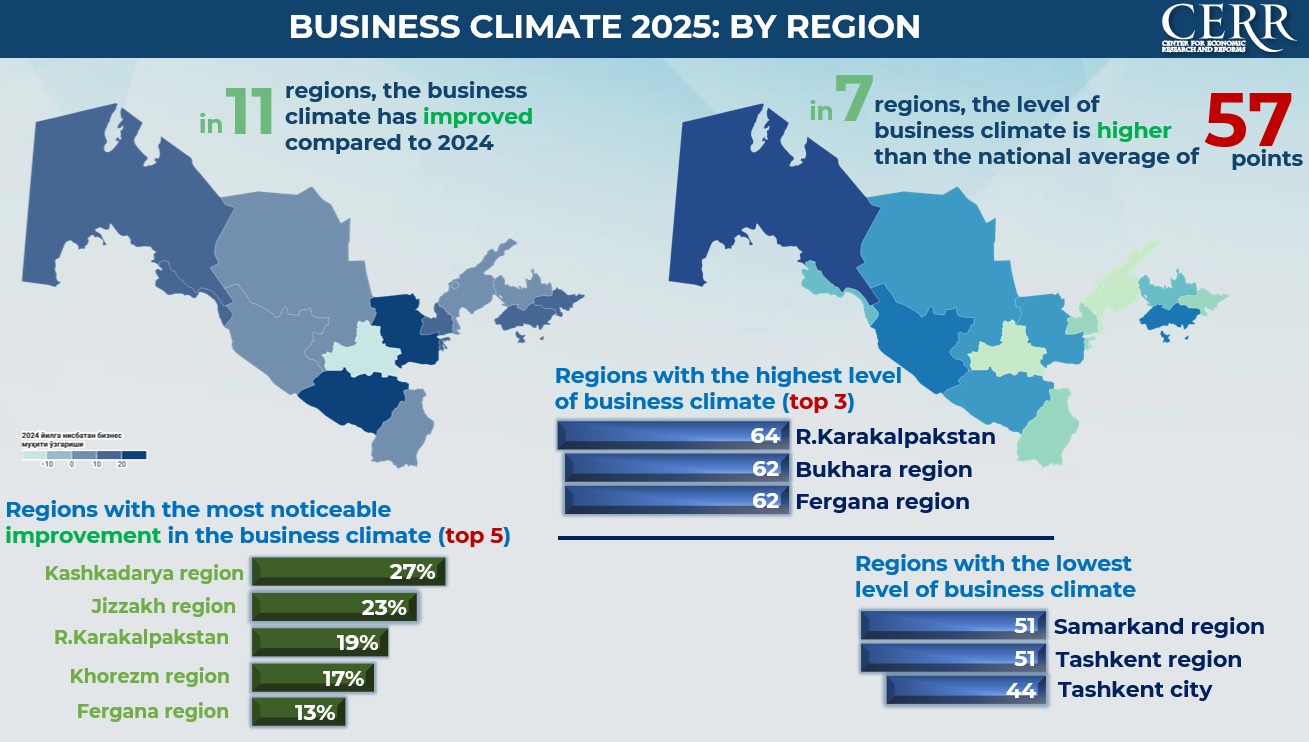

From a regional perspective, the annual average Business Climate Index increased compared to the previous year in 11 regions of the republic. In seven regions, the annual average value of the index reached 57 points.

The most pronounced improvement in business climate conditions was observed in Kashkadarya region, where the index increased by 27%, followed by Jizzakh region with a 23% increase and Khorezm region with a 17% increase. In the Republic of Karakalpakstan, growth amounted to 19%.

In Samarkand region, despite a slight decline in the index, the annual average business climate remained in positive territory at 51 points. In Tashkent region, the indicator remained unchanged at 44 points.

Business Expectations Regarding Price Dynamics and Demand

In terms of business expectations, inflationary and market assessments remained moderate in 2025. On average, 23% of companies expected price increases in the near term, which is 2 percentage points lower than in 2024.

During the year, the share of entrepreneurs expecting price increases fluctuated within the range of 18–27%, reaching a peak in April and the lowest levels in September and December. The highest price expectations were observed among enterprises in agriculture and construction, reflecting sector-specific cost structures as well as the impact of seasonal and weather-related factors.

At the same time, assessments of market conditions remained relatively strong. On average, 66% of entrepreneurs expected an increase in demand for goods and services, while 57% of companies planned to expand their workforce. Overall, the results indicate the persistence of positive expectations regarding business activity and employment, alongside more restrained assessments of price dynamics.

Assessments of Demand and Employment

The Employment Index in 2025 amounted to 43 points, corresponding to a 12% increase. The most significant growth was recorded in the services sector at 14%, construction at 17%, industry at 7%, and agriculture at 11%. Throughout the year, employment dynamics remained moderate, with sustained demand for labor.

The Demand Index also showed improvement. Its annual average value reached 48 points, representing an increase of 13%. The largest contribution came from the services sector, where the index increased by 19%, while in construction, industry, and agriculture the Demand Index rose by 6% in each sector. During the year, the index remained relatively stable, with stronger positive assessments in the second half of 2025.

Barriers to Entrepreneurial Activity

Over the course of the year, a gradual reduction in barriers to doing business was observed. According to the results, 60% of entrepreneurs reported that they did not face difficulties in conducting business, which is 6% higher than in 2024.

In industry, problems related to electricity supply decreased by 4%, high tax rates by 3%, and access to financing by 3%.

At the same time, in agriculture and construction, financing-related barriers declined significantly, by 7% and 5%, respectively.

Despite the overall reduction in complaints, financing remained the main obstacle cited by entrepreneurs in construction and industry, reported by 11% of respondents in each sector.

Overall, sectoral data indicate an increase in the share of entrepreneurs who do not face significant constraints, as well as a decline in the importance of financial and infrastructure barriers.

The Business Climate Change Indicator is constructed based on the methodology of the Ifo Institute (Germany). As part of the surveys, company managers assess current and expected changes in business activity based on developments in production, demand, prices, and other indicators.

Source: Review.uz