Iqtisodiyotning sekin o’sishi Yevropa va Markaziy Osiyo mamlakatlari shakllanayotgan bozorida tiklanishini susaytirmoqda

VASHINGTON, 2024-yil 11-aprel – Yevropa va Markaziy Osiyoda shakllanayotgan bozorida va rivojlanayotgan iqtisodiyotlarda iqtisodiy faollik bu yil sekinlashishi mumkin, chunki mintaqadagi oʻsish istiqbollari zaiflashgan global iqtisodiyot va qattiq pul-kredit siyosati, Xitoyda o’sish sur’atlarining pasayishi va iqtisodiy o’sish sur’atlarining pasayishi mintaqadagi iqtisodiy o’sish istiqbollariga salbiy ta’sir ko’rsatmoqda. Bu haqida Jahon bankining bugun chop etilgan mintaqa iqtisodiyotiga oid hisobotida aytilgan.

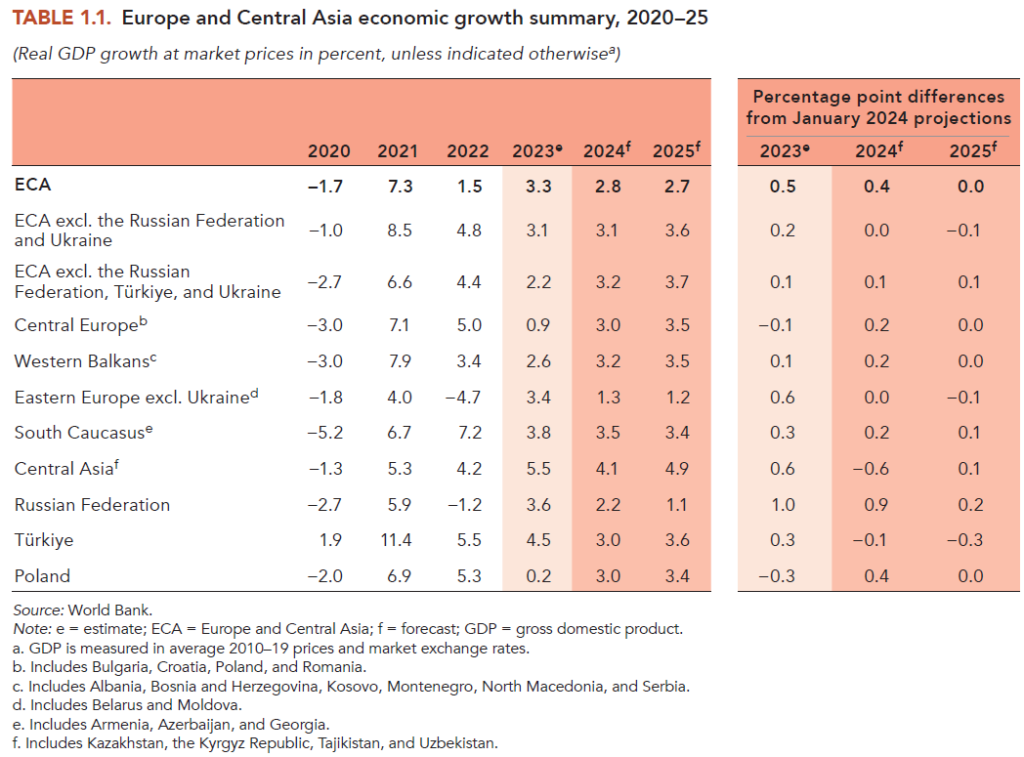

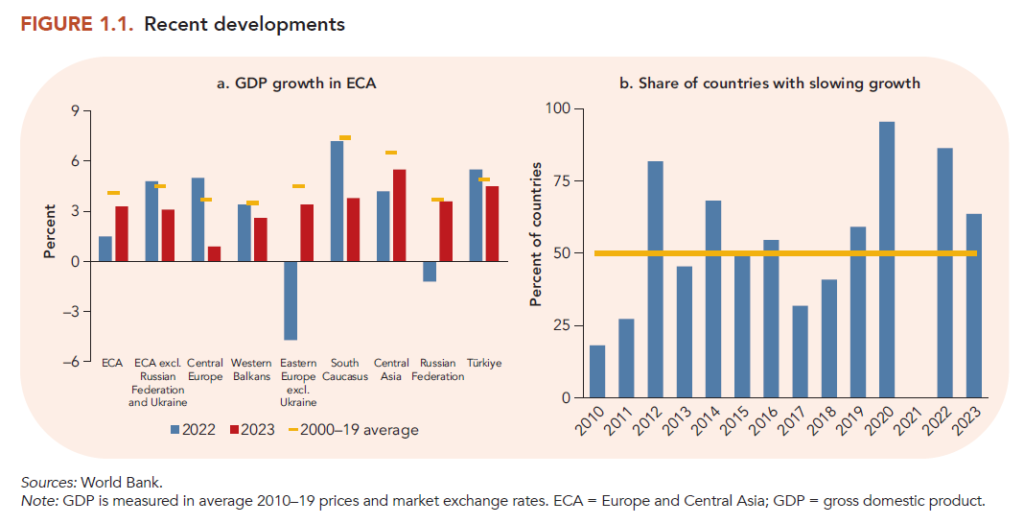

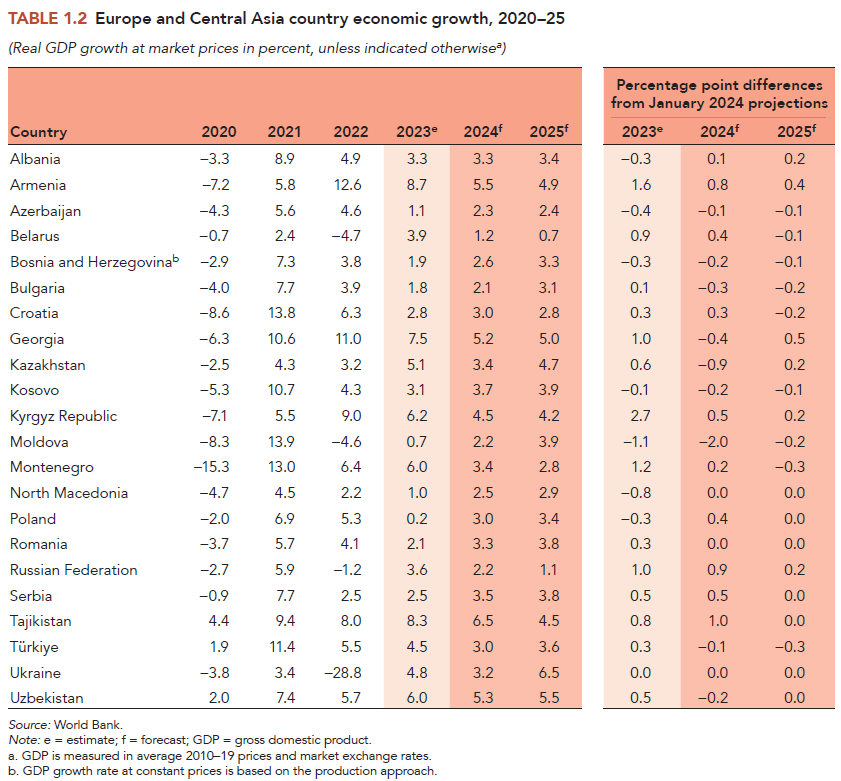

Rossiyada ham, urushdan vayron boʻlgan Ukrainada ham oʻsishning tiklanishi va Markaziy Osiyoda kuchliroq iqtisodiy tiklanish natijasida 2023-yilda 3.3% ga kuchli oʻsishdan soʻng mintaqadagi iqtisodiy oʻsish bu yil ehtimol 2,8% gacha sekinlashishi mumkin. 2025 yilda mintaqada ishlab chiqarishning o’sish sur’atlari deyarli o’zgarishsiz qolishi mumkin.

Ushbu prognozni amalga oshirish ko’plab xavf-xatarlar bilan tahdid qilinadi. Mintaqadagi iqtisodiy o’sish, asosiy savdo hamkorlarida, ayniqsa, Yevro hududda kutilganidan sekinroq tiklanish, cheklovchi pul-kredit siyosati va geosiyosiy keskinlikning yomonlashuvi tufayli yanada zaiflashishi mumkin.

“Yevropa va Markaziy Osiyo mamlakatlari global iqtisodiy o‘sishning zaifligi tufayli ko‘plab inqirozlarga duch kelishda davom etmoqda”, dedi Jahon bankining Yevropa va Markaziy Osiyo bo‘yicha vitse-prezidenti Antonella Bassani. «Biznes dinamikasini rag’batlantirish va iqlim o’zgarishi xavfiga chidamlilikni oshirish orqali hosildorlik o’sishini tiklash mintaqa aholisini himoya qilishga va iqtisodiy o’sishni oshirishga yordam beradi«.

Iqtisodiy o’sishning sustligi mintaqaning so’nggi zarbalardan, jumladan, Rossiyaning Ukrainaga bostirib kirishi, pandemiya va 2022 yildagi yashash xarajatlarining inqirozidan tiklanishini yanada kechiktiradi.

Yevropa va Markaziy Osiyoda shakillanayotgan bozor va rivojlanayotgan mamlakatlarda (EMED) inflyatsiya kutilganidan tezroq pasayib bormoqda, bu ko‘p jihatdan global oziq-ovqat va energiya narxlarining keskin pasayishi tufayli. Oʻrtacha yillik isteʼmol narxlari oʻsishi 2023-yil boshidagi 15 foizdan 2024-yil fevraliga kelib 4,2 foizga kamaydi. Biroq, o’tgan yili real daromadlar ko’tarilganiga qaramay, 2022 yilgi yashash xarajatlari inqirozi uy xo’jaliklariga ta’sir qilishda davom etmoqda.

Ukrainada iqtisodiy tiklanish 2023 yildagi 4,8 foizdan bu yil 3,2 foizgacha sekinlashishi prognoz qilinmoqda, bu esa hosilning kamayishi va mehnat bozorida davom etayotgan keskinlik tufayli. Mamlakatning iqtisodiy istiqbollari xorijiy yordam oqimiga va Rossiya bosqinining davomiyligiga bog’liq. Jahon banki va hamkor agentliklarning so‘nggi hisob-kitoblariga ko‘ra, Ukrainani rekonstruksiya qilish va qayta qurish uchun mablag‘ga bo‘lgan ehtiyoj 2021 yilda 486 milliard dollargacha oshgan, bu Ukrainaning urushgacha bo‘lgan iqtisodiyotidan ikki baravar ko‘pdir.

Turkiyaning iqtisodiy o’sishi ham bu yil 3% gacha sekinlashishi mumkin, bu pandemiya yillarini hisobga olmaganda, 2009 yildan beri eng zaif, chunki moliyaviy konsolidatsiya harakatlari ichki talabni cheklashi kutilmoqda. Jahon bozorida neft narxining past darajasi Markaziy Osiyoning barcha mamlakatlaridagi iqtisodiy vaziyatga ta’sir qiladi: joriy yilda o‘sish sur’atlari 4,1 foizgacha pasayishi kutilmoqda, 2023 yilda esa ular 5,5 foizni tashkil etadi.

Hisobotda xususiy sektorni rivojlantirish uchun shart-sharoitlar yaratish bo’yicha tematik bob mavjud.

Unda ta’kidlanganidek, hududning iqtisodiy rivojlanishi rejali iqtisodiyotdan bozor iqtisodiyotiga o‘tish, keng va chuqur tarkibiy islohotlarni amalga oshirish va xususiy tashabbusning iqtisodiy o‘sish va farovonlikning asosiy harakatlantiruvchi kuchi sifatida yuzaga kelishi tarixidir.

O’ttiz yildan kamroq vaqt ichida mintaqaning 12 ta davlati Yevropa Ittifoqiga (EI) qo’shildi. Bu mamlakatlarning barqaror institutlari va ishlab chiqarish tuzilmalariga ega boʻlgan Yevropa Ittifoqi bilan integratsiyalashgan bozor iqtisodiyotiga oʻtishi baʼzi mamlakatlar chuqur islohotlarni muvaffaqiyatli amalga oshirganligi hamda yuqori daromadli mamlakatlarga aylanganini yaqqol koʻrsatadi.

“Mintaqaning bir qancha mamlakatlaridagi xususiy sektor uning kengayishiga va innovatsiyalarga to‘sqinlik qiladigan to‘siqlarga duch kelmoqda”, dedi Jahon bankining Yevropa va Markaziy Osiyo mintaqasi bo‘yicha bosh iqtisodchisi Ivaylo Izvorski. “Biznesning jadal rivojlanishini jadallashtirish uchun raqobat muhitini yaxshilash, davlatning iqtisodiyotdagi ishtirokini qisqartirish, ta’lim sifatini oshirish va kompaniyalarni moliyalashtirish imkoniyatlarini kengaytirish kabi qator muammolarni hal qilish kerak bo‘ladi”.

Raqobat va erkin bozorlarni rag’batlantirishga qaratilgan sa’y-harakatlar, birinchi navbatda, bozorga kirish uchun to’siqlarni kamaytirish va samarasiz kompaniyalarning bozordan chiqishini osonlashtirishga qaratilishi kerak. Davlat korxonalarining sezilarli darajada mavjudligi ham xususiy korxonalar uchun teng sharoit yaratishga jiddiy to‘siq bo‘lmoqda.

Xususiy kompaniyalar, shuningdek, ishchilar o’rtasida ma’lumot darajasining etarli emasligi va malakali kadrlarning sezilarli darajada etishmasligiga duch kelmoqda. Ikkala omil ham o’sish uchun jiddiy to’siqdir. Yosh va malakali ishchilarning emigratsiyasining yuqori sur’atlari qisqa muddatda vaziyatni yaxshilashga yordam bermaydi. Ishchilarning bilim darajasini oshirish mehnat unumdorligini oshiradi va katta innovatsiyalarga olib kelishi mumkin.

Banklarning xususiy sektorni kreditlash darajasi nisbatan past darajada va so‘nggi o‘n yil ichida o‘smagan. Bundan tashqari, kredit berish odatda qisqa muddatli xarakterga ega. Kompaniyalar mahsuldorlik va innovatsiyalarni yaxshilash uchun uzoq muddatli moliyadan foydalanishlari kerak.

O’ZBEKISTON:

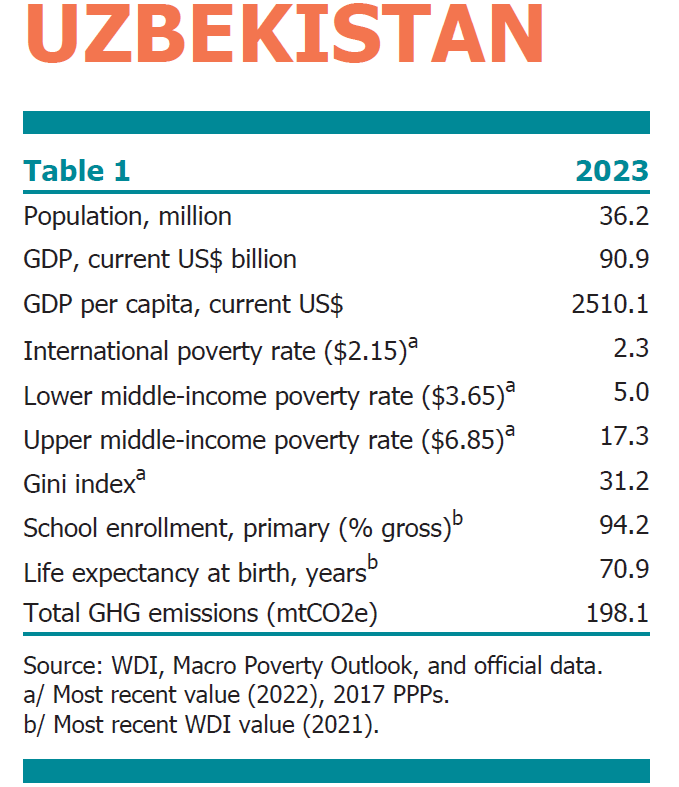

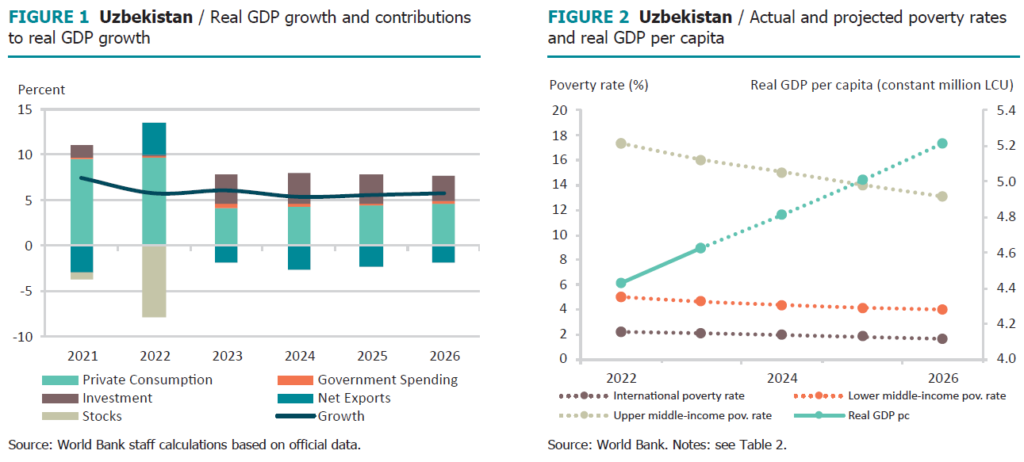

Keng ko’lamli kengayish va fiskal rag‘batlantirish tufayli mamlakat iqtisodiyoti 2023 yilda 6 foizga o‘sdi. Hukumat 2023 yilda byudjet taqchilligini kengaytirgandan so’ng 2024 yilda byudjet xarajatlarini birlashtirishi kutilmoqda. Haqiqiy ish haqining o’sishi 2023 yilda qashshoqlikni kamaytirishga yordam berdi.

Oʻrta muddatli istiqbol ijobiydir, chunki ulugʻvor va davom etayotgan tarkibiy islohotlar asosiy tarmoqlarda ishbilarmonlik muhitini yaxshilash, xususiy investitsiyalar va oʻsishni ragʻbatlantirishi kutilmoqda.

Barqaror iqtisodiy o’sish qashshoqlikni kamaytirishi kutilmoqda.

Asosiy shartlar va qiyinchiliklar

So‘nggi yillarda O‘zbekistonda iqtisodiyotning ayrim tarmoqlarini liberallashtirish, xususiy sektorni rivojlantirish istiqbollarini yaxshilash imkonini beruvchi keng ko‘lamli islohotlar amalga oshirildi.

2023 yilda hukumat mustaqil energiya regulyatorini tashkil etdi, energiya tariflari islohotini boshladi, davlat temir yo’l operatori qayta tuzildi, yirik kimyo zavodi va bankni xususiylashtirdi va raqobatni rag’batlantirish uchun etakchi kimyo davlat korxonasini ajratib oldi.

Shuningdek, ular Ijtimoiy himoya qilish milliy agentligini tuzdilar, gender zo’ravonligiga qarshi kurash bo’yicha yangi qonunchilikni kiritdilar va bepul yuridik yordam olish imkoniyatlarini kengaytirdilar. O‘zbekiston ham ekologik o‘tish yo‘liga kirib, yanada ulkan ekologik maqsadlarni, ifloslanishni nazorat qilishning yangi tizimini va milliy yashil taksonomiyani belgilab oldi.

Aholining yuqori o’sishi va har yili mehnat bozoriga ko’p sonli yoshlar kirib kelishi bilan iqtisodiy o’sish yangi ish o’rinlari yaratilishini qo’llab-quvvatlashi kerak.

Bunga erishish uchun O‘zbekiston bozorlarni ochish va raqobatni rag‘batlantirish bo‘yicha islohotlar dasturini davom ettirishi, xususan, davlat korxonalarining iqtisodiyotdagi ustunligini kamaytirish, yerga bo‘lgan huquqni mustahkamlash, telekommunikatsiya sohasi va xomashyo savdosini liberallashtirish, shuningdek, bozorlarning yuqori savdo xarajatlarini qisqartirish yo‘li bilan davom etishi zarur. Tezroq ish o‘rinlari yaratish va mehnat unumdorligini oshirish ham ishchi kuchining malakasini oshirishni talab qiladi.

Oxirgi yaxshilanishlar

2023-yilda real yalpi ichki mahsulot investitsiyalar, xususiy iste’mol va eksport hisobiga 6 foizga o‘sdi. Investitsiyalar o‘sishi davlat korxonalari va xususiy sektorni kreditlashning ko‘payishi hisobiga tezlashdi. Real kreditlash (davlat korxonalari va xususiy sektorga kreditlar) 2022-2023 yillarda 11,6 foizga o‘sdi, 2021-2022 yillardagi 5,1 foizdan.

Iste’mol narxlari inflyatsiyasi 2022 yildagi 12,3 foizdan 2023 yil dekabr oyida 8,8 foizga tushib, etti yil ichida eng past darajaga tushdi. Bunga barqaror pul-kredit siyosati, shuningdek, QQS stavkasining pasayishi hamda oziq-ovqat va energiya mahsulotlarining xalqaro narxlarining pasayishi sabab bo’ldi.

2023-yilda o‘zbek so‘mi AQSH dollariga nisbatan 9 foizga qadrsizlandi, bu qisman Rossiya rublining (bir-biriga yaqin savdo valyutasi) AQSh dollariga nisbatan qadrsizlanishining passiv ta’siri bilan bog‘liq.

Joriy hisob taqchilligi importning tez o’sishi va 2023 yilda pul o’tkazmalarining kamayishi (oxirgisi rublning zaiflashishi tufayli) tufayli yomonlashdi. O‘zbekistondan gaz eksporti ikki baravarga qisqardi va ichki gazga bo‘lgan ehtiyoj ortib borayotgan bir sharoitda O‘zbekiston 2023-yilda birinchi marta Rossiyadan gaz import qila boshladi.

Sovuq qishda energetika infratuzilmasi va yoqilg‘i uchun favqulodda xarajatlar, ish haqi va ijtimoiy nafaqalar, energiya subsidiyalari va davlat korxonalarini davlat tomonidan subsidiyalangan kreditlash xarajatlarining ko‘payishi hisobiga byudjet taqchilligi 2022 yildagi 4,1 foizdan 2023 yilda yalpi ichki mahsulotga nisbatan 5,8 foizga oshgan. banklar. Valyuta zahiralari 2023-yil dekabriga qadar 34,6 milliard AQSh dollarini tashkil etdi, bu 8 oydan ortiq potentsial importni anglatadi.

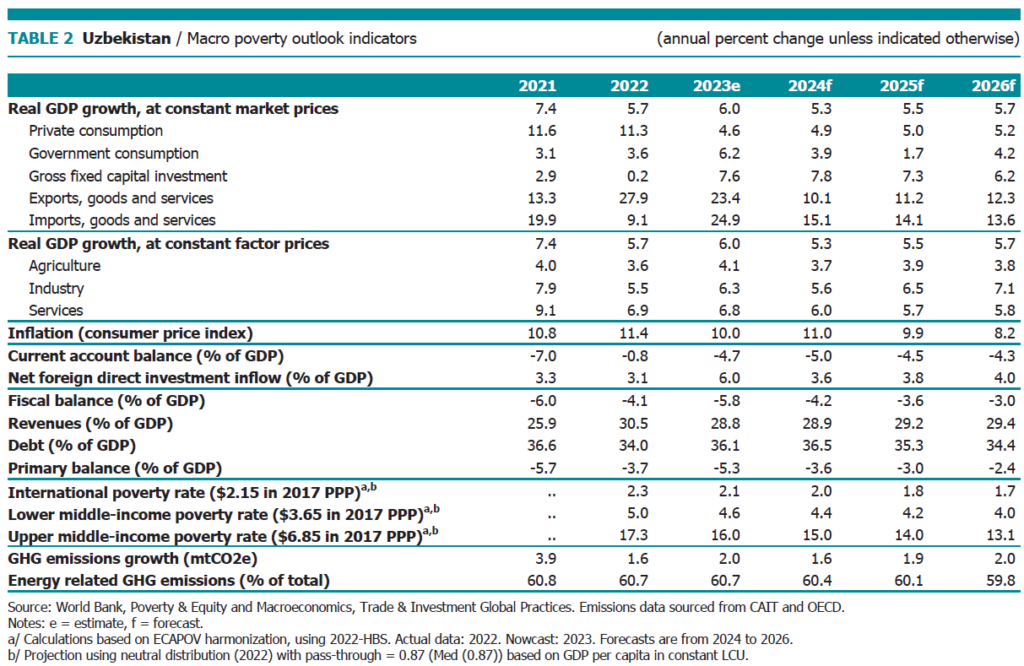

Haqiqiy ish haqining o’sishi kambag’allik darajasining 2022 yildagi 5,0% dan 2023 yilda 4,5% gacha pasayishiga yordam berdi, bu o’rta va past daromadli mamlakatlarning qashshoqlik chegarasi (kuniga $ 3,65, 2017 PPP) bilan o’lchanadi. Ishsizlik darajasi 2022 yildagi 8,9 foizdan 2023 yilda 8,1 foizga tushdi.

O‘rtacha real ish haqi 2023-yilda nafaqat talabning o‘sishi, balki mehnat bozorida malakali kadrlar yetishmasligi tufayli ham 7,8 foizga oshdi. Natijada, kambag’allarga qaraganda ko’proq malakali (va yaxshiroq ta’minlangan) ishchilar orasida ish haqining o’sishi daromadlar tengsizligining kuchayishiga olib keldi.

Prognoz

2024-yilda yalpi ichki mahsulotning o‘sishi kutilayotgan fiskal konsolidatsiyasi va O‘zbekistonning asosiy savdo hamkorlari bo‘lgan Rossiya va Xitoyga eksport o‘sish sur’atlarining sekinlashishini hisobga olgan holda 5,3 foiz darajasida prognoz qilinmoqda. O‘sish asosan tarkibiy islohotlarni davom ettirish, xususan, davlat korxonalarini tarkibiy o‘zgartirish va xususiylashtirish, shuningdek, energetika sohasiga yuqori investitsiyalar jalb etish hisobiga qo‘llab-quvvatlanadi.

Energiya tariflari islohoti tufayli (ijtimoiy himoya choralari bilan birga) energiyaning ichki narxlarining nisbatan keskin oshishi hisobiga 2024 yilda inflyatsiyaning oshishi kutilmoqda. Bu Markaziy bank inflyatsiyani toʻliq maqsadli belgilashga oʻtishni yakunlagach, qattiq pul-kredit siyosatini qoʻllash orqali qisman qoplanadi. O‘rta muddatli istiqbolda inflyatsiya darajasi 8 foizga tushib, Markaziy bankning 5 foizlik maqsadidan yuqori bo‘lishi kutilmoqda.

Import o’sishi 2024 yilda sekinlashishi kutilmoqda, ammo import ham iqtisodiy modernizatsiyani, ham iste’molni oshirishni qo’llab-quvvatlaganligi sababli kuchli bo’lib qolmoqda.

2024-yilda pul o‘tkazmalari qisqarishi prognoz qilinmoqda, bu asosan Rossiyaga mehnat muhojirlari sonining kutilayotgan qisqarishi bilan bog‘liq. Pul o’tkazmalarining kamayishi va kuchli import bilan joriy hisob taqchilligi biroz oshadi, ammo O’zbekistonning transformatsiya jarayoni taqchillikni moliyalashtirish uchun xorijiy jamg’armalarni jalb qilgani uchun barqaror bo’lib qoladi. Ushbu iqtisodiy prognoz 2024 yilda kambag’allik darajasining 4,3% gacha kamayishiga olib kelishi kutilmoqda.

Davlat korxonalari uchun maqsadli boʻlmagan yirik energiya subsidiyalari va samarasiz ragʻbatlantirishlar olib tashlanishi hamda xususiylashtirishdan tushgan mablagʻlardan byudjet daromadlarining koʻpayishi natijasida byudjet taqchilligi 2024-yilda YaIMning 4,2 foiziga, 2026-yilga kelib esa YaIMning 3 foizigacha kamayishi kutilmoqda. Hukumat qarz limitlariga (jami davlat va davlat tomonidan kafolatlangan qarz uchun YaIMning 60%) rioya qilishi kutilmoqda, davlat qarzi 2024 yilda YaIMning 36,5 foizigacha ko’tarilib, 2026 yilga kelib asta-sekin YaIMning 34,4 foizigacha pasayadi.

Prognoz uchun xavflar pastga siljiydi. Tashqi xatarlarga asosiy savdo hamkorlari, xususan, Xitoy va Rossiya o‘rtasidagi o‘sish sur’atlarining mumkin bo‘lgan yomonlashuvi, shuningdek, tashqi moliyaviy sharoitlarning yanada qattiqlashishi kiradi. Ichki risklar davlat korxonalari, davlat-xususiy sheriklik va davlat banklarining shartli majburiyatlarining ortib borishi bilan bog’liq. Potensial ijobiy omillar qatoriga jahon bozorida oltin va mis narxlarining ko‘tarilishi, shuningdek, amalga oshirilayotgan tarkibiy islohotlar tufayli mehnat unumdorligining oshishi kiradi.

Manba: Press-reliz №: 2024/ECA/085