According to the information of the World Gold Council In October, the Central Bank of the Republic of Uzbekistan became the largest seller of gold in the world, selling 11 tons of gold.

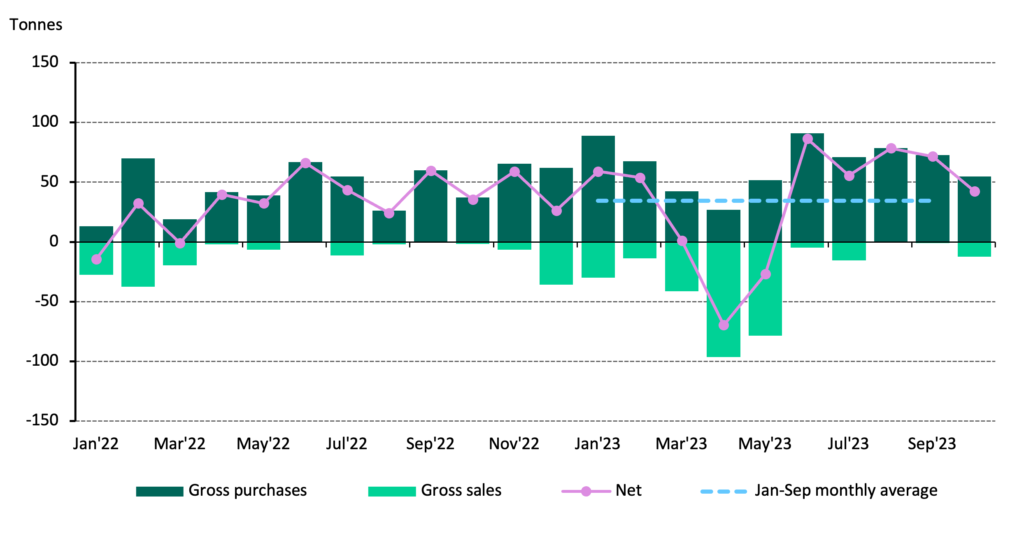

- Central banks added a net 42 tonnes to global official gold reserves in October

- October saw higher sales volumes compared to the previous two months – led by Uzbekistan and Kazakhstan.

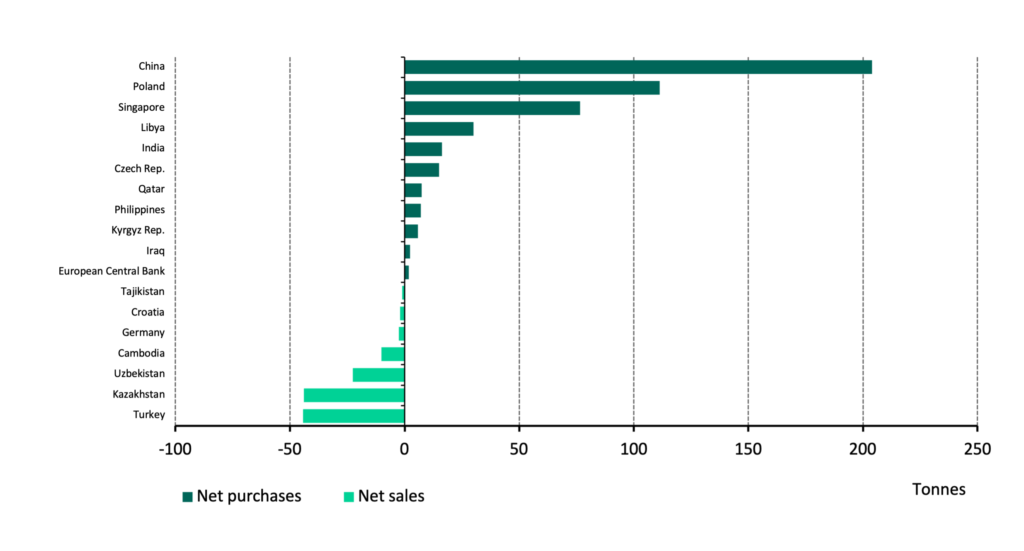

- The People’s Bank of China was again the largest buyer, followed by the Central Bank of Turkey and National Bank of Poland

Central banks’ gold buying slowed in October but did nothing to alter the overall trend of robust buying that has captured the attention of gold investors. Reported global net purchases totalled 42 tonnes (t) during the month, 41% lower than September’s revised total of 72t, but still 23% above the January-September monthly average of 34t.

Country-level activity followed a familiar theme: a small number of banks accounting for the global total. The People’s Bank of China remained the largest purchaser, reporting the addition of 23t of gold to its reserves – the twelfth consecutive monthly addition. This brings its y-t-d net purchases to 204t and lifts its reported gold reserves to 2,215t. Despite the significant increase, reported gold reserves still account for just 4% of the bank’s total international reserves.

The Central Bank of Turkey also made a significant addition during the month. It bought 19t to increase its official gold reserves (central bank plus Treasury holdings) to 498t. On a y-t-d basis the central bank still remains a net seller (44t) as a result of its heavy net sales between March-May.

Beyond these two banks, buying was more modest. The National Bank of Poland continued its recent buying spree, adding a further 6t to its gold reserves. Its gold holdings have now risen by over 100t this year, to 340t. The Reserve Bank of India (3t), the Czech National Bank (2t), the National Bank of the Kyrgyz Republic (1t) and the Qatar Central Bank (1t) were the other significant buyers in October.

October also saw a higher volume of sales compared to August and September. These sales were driven by the Central Bank of Uzbekistan (11t) and the National Bank of Kazakhstan (2t). We have often noted that both banks frequently flip between net buying and selling, which is not uncommon for banks who buy gold from domestic sources.

Even before October’s net buying, we noted that 2023 was likely to be another colossal year of central bank buying. Having started Q4 positively, this year’s central bank demand looks set to climb even higher.

Source: World Gold Council